Homeowners Insurance in and around Rapid City

Looking for homeowners insurance in Rapid City?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Rapid City

- Box Elder

- Piedmont

- Hermosa

- Black Hawk

- Ellsworth

- Ellsworth AFB

- Sturgis

- Spearfish

- Hill City

- Custer

- Hot Springs

- Wall

- Kadoka

- Phillip

- Murdo

- Northern Hills

- Southern Hills

- Black Hills

- Pennington County

- Meade County

- Custer County

- Lead Deadwood

- Fall River County

Home Is Where Your Heart Is

Your home and property have monetary value. Your home is more than just a roof over your head. It’s all the memories you hold dear. Doing what you can to keep your home protected just makes sense! That’s why the most sensible step is to get outstanding homeowners insurance from State Farm.

Looking for homeowners insurance in Rapid City?

Give your home an extra layer of protection with State Farm home insurance.

Protect Your Home Sweet Home

Are you looking for a policy that can help protect both your home and your valuables? State Farm agent Jeff Johnson's team is happy to help you develop a policy that's right for your needs.

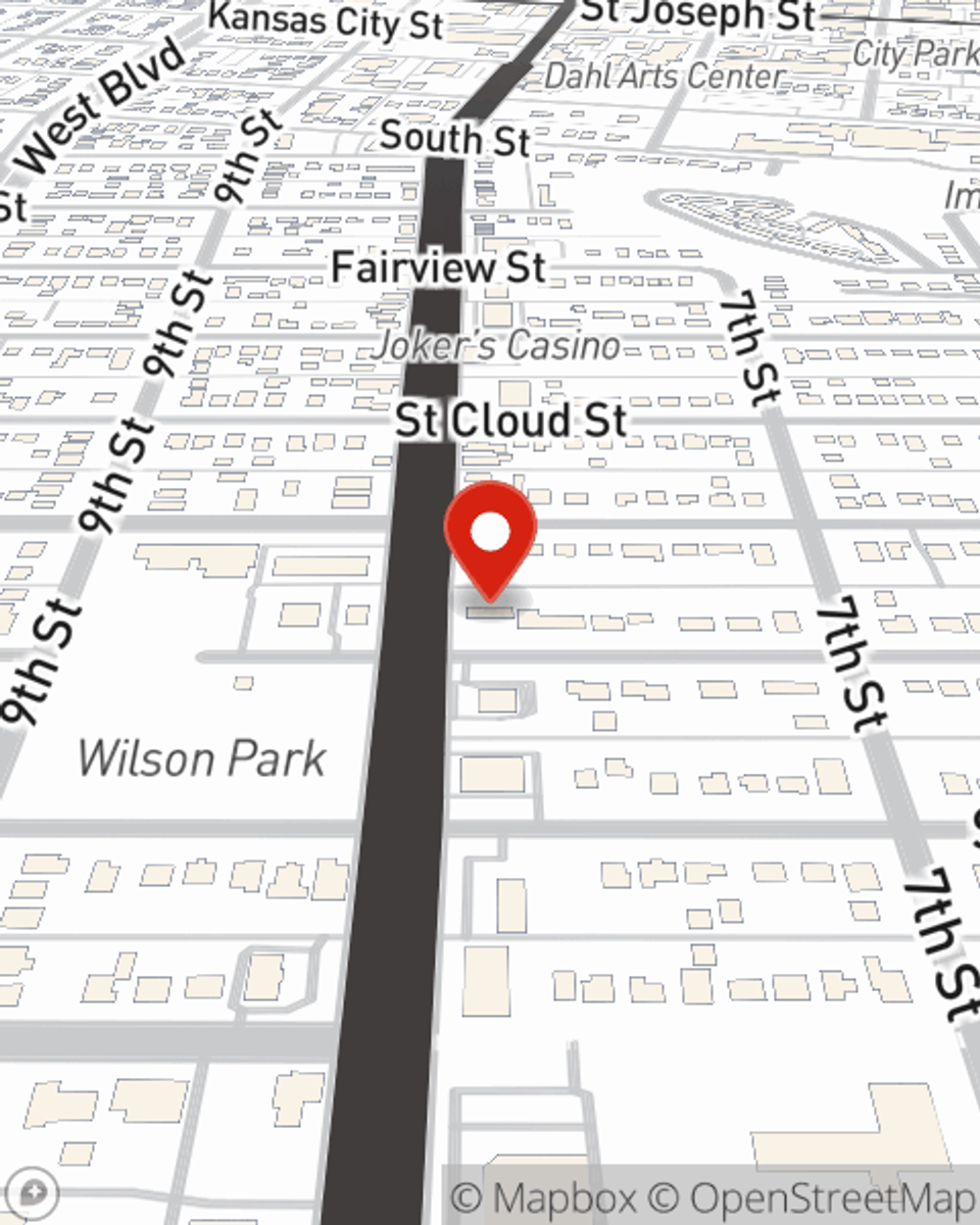

Remarkable homeowners insurance is not hard to come by at State Farm. Before the unpredictable happens, visit agent Jeff Johnson's office to help you figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Jeff at (605) 791-3333 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Jeff Johnson

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.